Information Security Compliance for Financial Services Companies in the US

Information Security Compliance for Financial Services Companies in the US

Companies offering financial services need to promote a strong compliance culture to nurture a community of satisfied shareholders and loyal customers. More importantly, since the State takes information security compliance quite seriously, non-alignment to compliance regulations is a direct invitation to legal action and monetary punishment. Here’s a guide to keep you updated about compliance requirements in the industry, and tips that will help your firm become more aligned with these rules and regulations.

Important Compliances for Financial Services Companies

- FINRA

The Financial Industry Regulatory Authority (FINRA) oversees the actions of brokerage firms and exchange markets. FINRA is not a part of the US government and is a self-regulatory organization. FINRA’s rules comprehensively cover the aspects of broker-dealer operations. Rules are laid down for ethics, duties, and possible conflicts. Other regulations meant for transactions with clients, mediations, and disciplinary proceedings are also clearly stated. - Payment Card Industry Data Security Standard (PCI-DSS)

PCI compliance refers to a set of requirements that must be fulfilled by financial services providers who wish to receive, store, and use credit card details. There are 12 requirements of PCI-DSS, which include proper usage and maintenance of firewalls, password protection, encryption of transmitted data, robust anti-virus, updated software, etc. - FIPS

FIPS or Federal Information Processing Standards need to be met by any financial services company operating in the US. The FIPS lays down requirements such as matching Digital Signature Standards, Security Requirements for Cryptographic Modules, Advanced Encryption Standards, etc. FIPS promotes financial compliance in the areas of Access control, Certification, accreditation and security assessments, Awareness training, Media protection, etc. - Sarbanes-Oxley Act

The Sarbanes-Oxley Act of 2002 was created to protect shareholders and employees from unethical financial practices. The Act mandates financial services companies to disclose the details of their internal accounting controls and the methodology used for financial reporting. Under the Sarbanes-Oxley Act, service providers will also be under the obligation of producing periodic transaction reports. Lastly, there are also rules for appointing independent auditors who cannot perform certain non-audit services when working on an annual audit project.

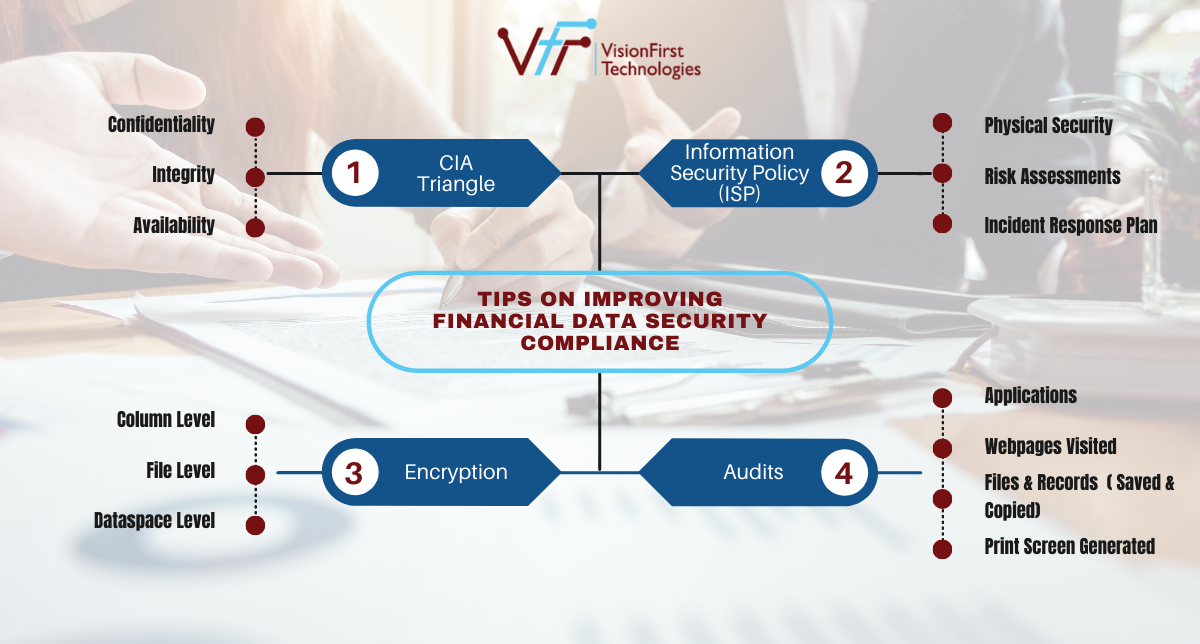

Tips On Improving Financial Data Security Compliance

- Start With The CIA Triangle

Confidentiality, Integrity, and Availability are three aspects that make information accessible as well as vulnerable. Ensure that only those with authorized permission are given access to data. Prevent any manipulation of details, and make information easily available to the stakeholders with no barriers whatsoever. - Working On The Information Security Policy (ISP)

Give your customers a detailed account of your existing information security policy. Cover all aspects such as physical security, risk assessments, Incident Response Plan, etc., in the Information Security Policy (ISP) declaration. - Encryption

Since it is a key component of almost all compliance acts and regulations, financial services providers should focus on protecting sensitive data with encryption. Column level, file level, dataspace level encryptions are ways of adding layers to information security. Encrypting data in transit via HTTPS or FTPS methods can also be a prudent step. - Audits

Being another active component of most compliance regulations, audits must be conducted periodically to identify any lapses, threats, etc. Moreover, logging of system events should also be done so that one can zero in on the servers that were compromised without wasting time in case of a cyber attack.

Conclusion

So, these were some important insights about information security compliances for financial services companies. In an industry where winning the customer’s trust is paramount to success, non-adherence to security regulations is nothing but a self-goal. Working on improving the all-around compliance of a company goes a long way in establishing productive business relationships, and keeps legal troubles at bay.